Meta’s $15 B Bet on Scale AI: The Deal That Redraws the Data-Labeling Landscape

June 11, 2025 • 5 min read

Meta’s nearly $15 billion deal for a 49 percent stake in Scale AI is more than just a headline-grabbing move; it represents a tectonic shift that fuses the world’s largest social network with the leading supplier of high-quality training data. Below is a comprehensive blog post that unpacks the deal, examines why Meta moved first, and outlines the ripple effects that will redefine the data-labeling industry’s economics, technology, and workforce.

The Deal at a Glance

Meta will invest $14.8 billion for a minority stake, but a blocking stake in Scale AI, valuing the San Francisco-based startup at just over $30 billion pre-money. The agreement allows Scale to remain legally independent while granting Meta board seats and preferred data-access rights, thereby sidestepping a full HSR antitrust review while drawing immediate regulatory attention in Washington and Brussels.

Key Figures

| Metric | Detail |

|---|---|

| Stake | 49 % equity + super-voting observer seat |

| Cash outlay | $14.8 B (mix of cash + RSUs) |

| 2024 revenue | $870 M |

| 2025 projection | $2 B revenue; 130 % YoY growth |

| New joint unit | “Super-Intelligence Task Force” led by Scale CEO Alexandr Wang inside Meta |

Why Meta Pulled the Trigger

1. Securing a Proprietary Data Moat

Meta’s Llama models thrive on diverse, carefully aligned data. Scale’s Safety, Evaluations, and Alignment Lab (SEAL) provides red-teaming workflows and RLHF pipelines that Meta can now leverage first.

2. Cutting Training Costs

Internal estimates suggest that Scale’s auto-labeling pipelines and synthetic-data engines could shave 12-15% off tokens per GPU hour in future Llama training runs.

3. Talent & Tooling in One Shot

Roughly 600 machine-learning engineers, including teams focused on medical, defense, and autonomous datasets, will embed within Meta’s new super-intelligence organization.

What Scale AI Brings to the Table

Portfolio Snapshot

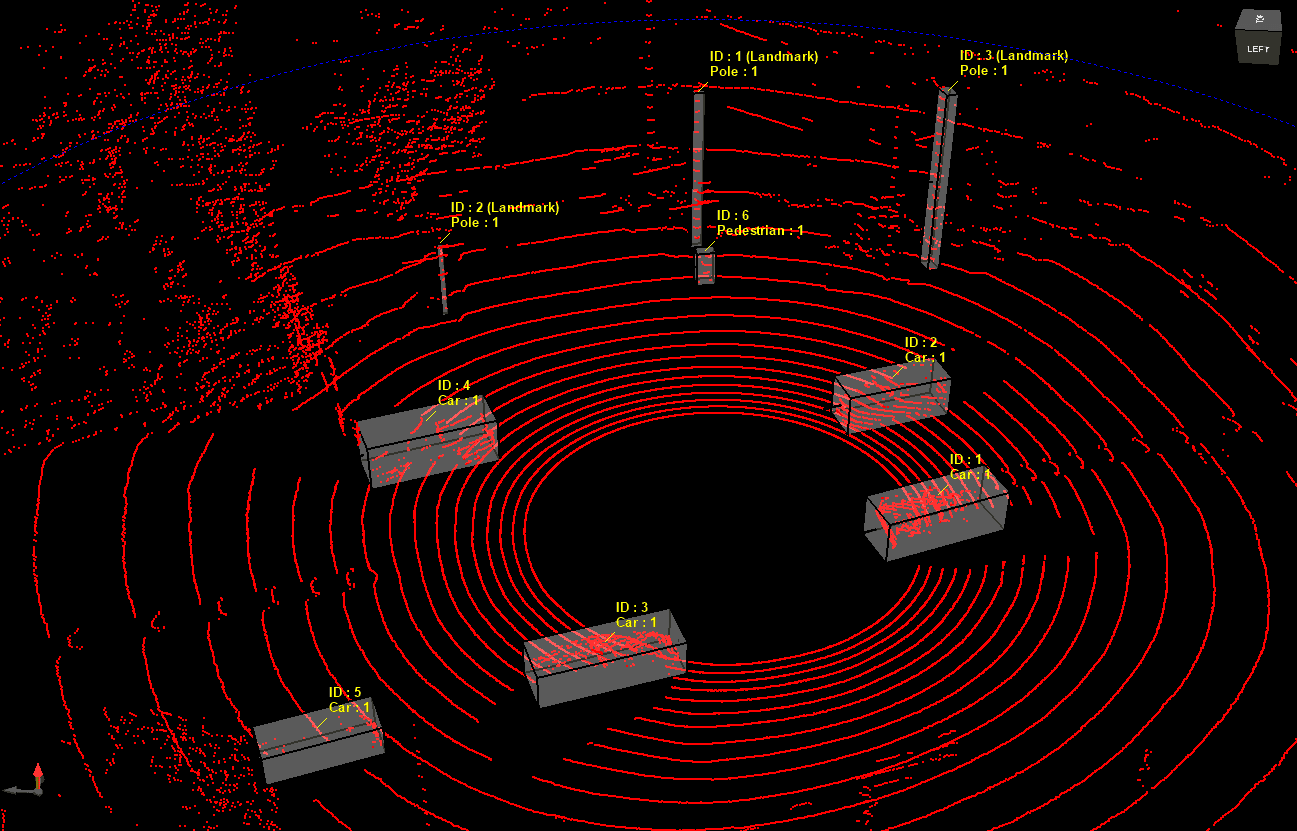

- Rapid – Real-time annotation for LiDAR, video, and multimodal streams

- Nucleus – Data versioning platform for dataset curation

- Synthetic Data – Procedurally generated 3-D worlds for autonomous driving and robotics

- SEAL – Alignment benchmarking + rater-assist tooling

Differentiators

Unlike traditional BPO-heavy rivals (Appen, iMerit), Scale is software-first: 38 % of 2024 labels were produced with ML-assisted automation, versus <15 % for peers.

Shockwaves Through the Data-Labeling Landscape

Market Size & Growth

The data collection and labeling sector hit $4.89 billion in 2025 and is tracking toward $29 billion by 2032 (28% CAGR).

Competitive Pressure

| Segment | Threat Level | Why |

|---|---|---|

| Service-centric BPOs (Appen, CloudFactory, iMerit) | High | Meta-Scale price bundles will undercut manual services by 10-20 %. |

| Tool vendors (Labelbox, V7) | Medium | Must accelerate auto-label and synthetic-data roadmaps or partner with hyperscalers. |

| Synthetic-data specialists (Synthesis AI, Rendered.ai) | Positive | Demand spikes as enterprises copy Meta’s synthetic workflows. |

Likely M&A Chain Reaction

Labelbox’s $189M war chest and V7’s $33M Series A funding leave both ripe for strategic buyouts, primarily by Microsoft or Amazon, which are looking to keep their data channels diversified.

Workforce & Ethical Fallout

Automation already halves manual annotation time on some image pipelines; analysts project a 30 % reduction in offshore labeling hours by 2027, squeezing markets in Kenya and the Philippines. Yet full automation remains risky, bias and model collapse still require human auditors.

Regulatory & Sovereignty Flashpoints

- FTC antitrust lens – The agency is fresh off a broad AI-competition hearing and may classify the stake as a “strategic acquisition of an essential input.”

- EU data sovereignty – Brussels is tightening rules on localized datasets; Meta has already delayed Llama releases due to GDPR concerns.

- G7 competition principles list AI data, chips, and compute as potential choke points, signaling closer scrutiny of partnerships like Meta-Scale.

Winners, Losers, and the Road Ahead

| Winners | Rationale |

|---|---|

| Meta | Proprietary data pipeline, faster model cycles, lower training spend |

| Synthetic-data Vendors | Surge in demand as enterprises emulate Meta’s cost structure |

| Niche Vertical Labelers | Healthcare / defense providers can defend margins with specialization |

| Losers | Rationale |

|---|---|

| Manual BPO Shops | Margin compression, talent drain to automated platforms |

| Independent LLM Startups | Harder to differentiate on data-quality moats |

What to Watch

- Labelbox & V7 fundraising or sale within 12 months.

- Regulatory test case if the FTC amends its ongoing Meta antitrust suit to add Scale.

- The open-source backlash should prompt Meta to restrict SEAL datasets, leading to calls for “public data utilities.”

Conclusion

Meta has bought more than a seat at the data-labeling table; it has effectively redrawn the seating chart. By plugging Scale AI’s automated, vertically integrated pipeline straight into its model-training engine, Meta gains a defensible moat while setting a new deflationary benchmark for the entire annotation industry. The shake-up will force service-heavy vendors to automate or niche down, push tool makers toward deeper machine learning (ML) integrations, and invite regulators to decide whether data is the new oil or the new antitrust flashpoint.